Types of cryptocurrency

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. https://fotomodellek.com/ Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

BNB is the cryptocurrency issued by Binance, one of the largest crypto exchanges in the world. While originally created as a token to pay for discounted trades, Binance Coin can now be used for payments, as well as purchasing various goods and services.

The third largest coin at the time of writing is quite different from Ether and BTC because it is a centralized cryptocurrency. Tether is the largest stablecoin that attempts to tie its price to the US Dollar. Tether is commonly abbreviated USD₮ or USDT. This stablecoin is owned by iFinex, which owns the Bitfinex exchange.

Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional.

Qubetics dVPN uses advanced features like multi-hop routing and end-to-end encryption to protect user identities and data. This makes it virtually impossible for malicious actors or governments to track or censor internet activity.

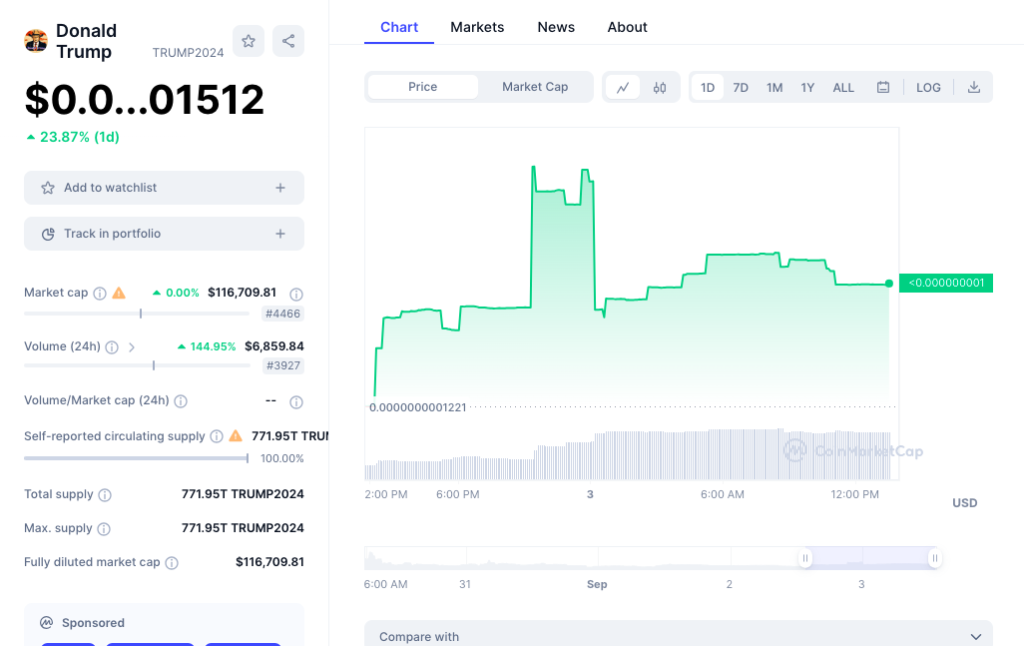

Cryptocurrency trump

No major party nominee has ever leveraged their candidacy for personal profit quite like Trump has during his third White House bid. Since entering the race nearly two years ago, Trump has netted millions of dollars selling new items featuring moments from his political life while also generating billions of dollars in wealth through a social media site where he speaks directly to supporters.

Throughout the nearly 50-minute speech, Trump repeatedly sought to contrast his support of cryptocurrency to the Biden’s administration efforts to regulate the industry, telling the crowd that the federal government was “blocking your way.” Trump said he wanted cryptocurrency “mined, minted and made” in the United States.

No major party nominee has ever leveraged their candidacy for personal profit quite like Trump has during his third White House bid. Since entering the race nearly two years ago, Trump has netted millions of dollars selling new items featuring moments from his political life while also generating billions of dollars in wealth through a social media site where he speaks directly to supporters.

Throughout the nearly 50-minute speech, Trump repeatedly sought to contrast his support of cryptocurrency to the Biden’s administration efforts to regulate the industry, telling the crowd that the federal government was “blocking your way.” Trump said he wanted cryptocurrency “mined, minted and made” in the United States.

Ulbricht created the underground drug-selling website Silk Road but was sentenced to life in prison after a judge held him responsible for six overdose deaths linked to his website. Some of the nearly 800 attendees who flocked to downtown Nashville to hear Trump speak wore “Free Ross Day One” hats, in a nod to Ulbricht’s prison sentence.

“This is a huge victory for crypto,” Kristin Smith, the CEO of the Blockchain Association, a D.C.-based lobbying group, tells TIME. “I think we’ve really turned a corner, and we’ve got the right folks in place to get the policy settled once and for all.”

What is cryptocurrency

Darknet markets present challenges in regard to legality. Cryptocurrency used in dark markets are not clearly or legally classified in almost all parts of the world. In the US, bitcoins are regarded as “virtual assets”. This type of ambiguous classification puts pressure on law enforcement agencies around the world to adapt to the shifting drug trade of dark markets.

Proof-of-work cryptocurrencies, such as bitcoin, offer block rewards incentives for miners. There has been an implicit belief that whether miners are paid by block rewards or transaction fees does not affect the security of the blockchain, but a study suggests that this may not be the case under certain circumstances.

On 19 October 2021, the first bitcoin-linked exchange-traded fund (ETF) from ProShares started trading on the NYSE under the ticker “BITO.” ProShares CEO Michael L. Sapir said the ETF would expose bitcoin to a wider range of investors without the hassle of setting up accounts with cryptocurrency providers. Ian Balina, the CEO of Token Metrics, stated that SEC approval of the ETF was a significant endorsement for the crypto industry because many regulators globally were not in favor of crypto, and retail investors were hesitant to accept crypto. This event would eventually open more opportunities for new capital and new people in this space.

Darknet markets present challenges in regard to legality. Cryptocurrency used in dark markets are not clearly or legally classified in almost all parts of the world. In the US, bitcoins are regarded as “virtual assets”. This type of ambiguous classification puts pressure on law enforcement agencies around the world to adapt to the shifting drug trade of dark markets.

Proof-of-work cryptocurrencies, such as bitcoin, offer block rewards incentives for miners. There has been an implicit belief that whether miners are paid by block rewards or transaction fees does not affect the security of the blockchain, but a study suggests that this may not be the case under certain circumstances.

On 19 October 2021, the first bitcoin-linked exchange-traded fund (ETF) from ProShares started trading on the NYSE under the ticker “BITO.” ProShares CEO Michael L. Sapir said the ETF would expose bitcoin to a wider range of investors without the hassle of setting up accounts with cryptocurrency providers. Ian Balina, the CEO of Token Metrics, stated that SEC approval of the ETF was a significant endorsement for the crypto industry because many regulators globally were not in favor of crypto, and retail investors were hesitant to accept crypto. This event would eventually open more opportunities for new capital and new people in this space.